Trive Review 2025: Is This Multi-Regulated Broker Safe and Legit?

Trive

British Virgin Islands

British Virgin Islands

-

Withdrawal Fee $0

-

Leverage 30:1

-

Spread From 0.5

-

Minimum Order 0.01

-

Forex Available

-

Crypto Available

-

Stock Available

-

Indices Available

Licenses

South Africa Retail Forex License

South Africa Retail Forex License

Hong Kong Securities and Futures License

Hong Kong Securities and Futures License

Australia Retail Forex License

Australia Retail Forex License

Forex & CFD Brokerage License

Forex & CFD Brokerage License

Softwares & Platforms

Customer Support

+441460944002

(English)

+441460944002

(English)

Supported language: Arabic, Chinese (Simplified), English, French, German, Hindi, Italian, Spanish

Social Media

Summary

Trive is a globally regulated broker offering a diverse range of financial instruments, including CFDs, forex, stocks, and ETFs. With licenses in 15 regions and regulation by the Malta Financial Services Authority (MFSA), Trive ensures a secure trading environment. Traders benefit from ultra-low spreads—starting from 0.1 pips on EURUSD—and rapid execution speeds under 0.1 seconds. The platform provides access to over 300 markets through advanced tools and platforms, such as Trive Trader and MetaTrader. Additionally, Trive offers 24/5 live support to assist its clients.

- Well-regulated by multiple respected authorities

- Wide range of tradable assets across forex, stocks, indices, commodities, and crypto

- Competitive spreads and flexible leverage options

- Choice of account types to suit different trading styles and needs

- MetaTrader 4, MetaTrader 5, and proprietary mobile app available

- Comprehensive educational resources, including webinars, tutorials, and market analysis

- 24/5 multilingual customer support via live chat, email, and phone

- No deposit or withdrawal fees for bank transfers

- Offers negative balance protection for some entities

- Provides access to Trading Central and MetaTrader Booster Pack tools

- Some country restrictions; not available to US or UK residents

- No confirmed current promotions or bonuses

- Inconsistent negative balance protection across entities

- Potential deposit/withdrawal fees for credit/debit cards and e-wallets

- VIP account requires a $2000 minimum deposit.

- Limited cryptocurrency offerings compared to some brokers

- Educational resources could be more structured and comprehensive.

- No 24/7 customer support

- Relatively high spreads/commission on ECN Zero account

- Broker primarily operates as a market maker.

Overview

Trive (formerly known as GKFX) is a global forex and CFD broker established in 2008, with a presence in Europe, Asia, Africa, and the Middle East. Trive Financial Holding, the parent company based in the Netherlands, operates multiple regulated entities worldwide, ensuring a high level of safety and security for clients' funds. The broker has gained recognition for its competitive trading conditions, advanced platforms, and commitment to innovation. Trive's sponsorship of the Bayer 04 Leverkusen football club reflects its values of teamwork, discipline, and success. For more details on Trive's offerings and services, visit their official website at trive.com. As a trusted industry player, Trive provides traders access to over 170 instruments across forex, stocks, indices, commodities, and cryptocurrencies. The broker incorporates the popular MetaTrader 4 and 5 platforms, along with a proprietary mobile trading app for flexibility. With tight spreads, diverse account types, and quality market research, Trive caters to both novice and experienced traders seeking a reliable partner in their investment journey. However, potential clients should carefully evaluate the broker's terms, conditions, and regulatory status to ensure alignment with their trading needs and risk tolerance.

Overview Table

| Aspect | Details |

|---|---|

| Foundation | 2008 |

| Headquarters | British Virgin Islands (Trive International Ltd) |

| Regulation | ASIC, MFSA, BVI FSC, FINRA, FSCA, CMB, BAPPEBTI |

| Trading Platforms | MetaTrader 4, MetaTrader 5, Proprietary mobile app |

| Instruments | Forex, Stocks, Indices, Commodities, Cryptocurrencies |

| Account Types | Standard, Pro Leverage, ECN Zero, VIP |

| Minimum Deposit | $0 - $15000 (depending on account type) |

| Maximum Leverage | Up to 1:30(depending on jurisdiction and account type) |

| Spreads | From 0.0 pips (ECN Zero) to 1.2 pips (Standard) |

| Deposit Methods | Bank transfer, Credit/debit card, E-wallets (Neteller, Skrill) |

| Withdrawal Methods | Bank transfer, Credit/debit card, E-wallets (Neteller, Skrill) |

Facts List

1. Trive is regulated by 9 entities globally, including ASIC, MFSA, BVI FSC, FINRA, FSCA, and CMB, ensuring a high level of safety for clients' funds.

2. The broker offers over 170 tradable instruments across forex, stocks, indices, commodities, and cryptocurrencies, providing diverse market access.

3. Trive incorporates the industry-standard MetaTrader 4 and 5 platforms, along with a proprietary mobile trading app for flexibility and convenience.

4. Clients can choose from four account types—Classic,Prime and Prome Plus

5. Maximum leverage varies based on jurisdiction and account type, with levels up to 1:2000 available for some clients.

6. Spreads start from 0.0 pips on the ECN Zero account and 1.2 pips on the Standard account, with the VIP account offering typical spreads from 0.6 pips.

7. Trive charges no fees for deposits and withdrawals via bank transfer but applies a 1.5% fee for credit/debit card and e-wallet transactions.

8. Withdrawal requests are processed within 1-3 business days, ensuring timely access to funds for clients.

9. The broker provides comprehensive market research and analysis from both in-house experts and third-party providers like Trading Central.

10. Customer support is available 24/5 via phone, email, and live chat, though user reviews on the quality and responsiveness of support are mixed.

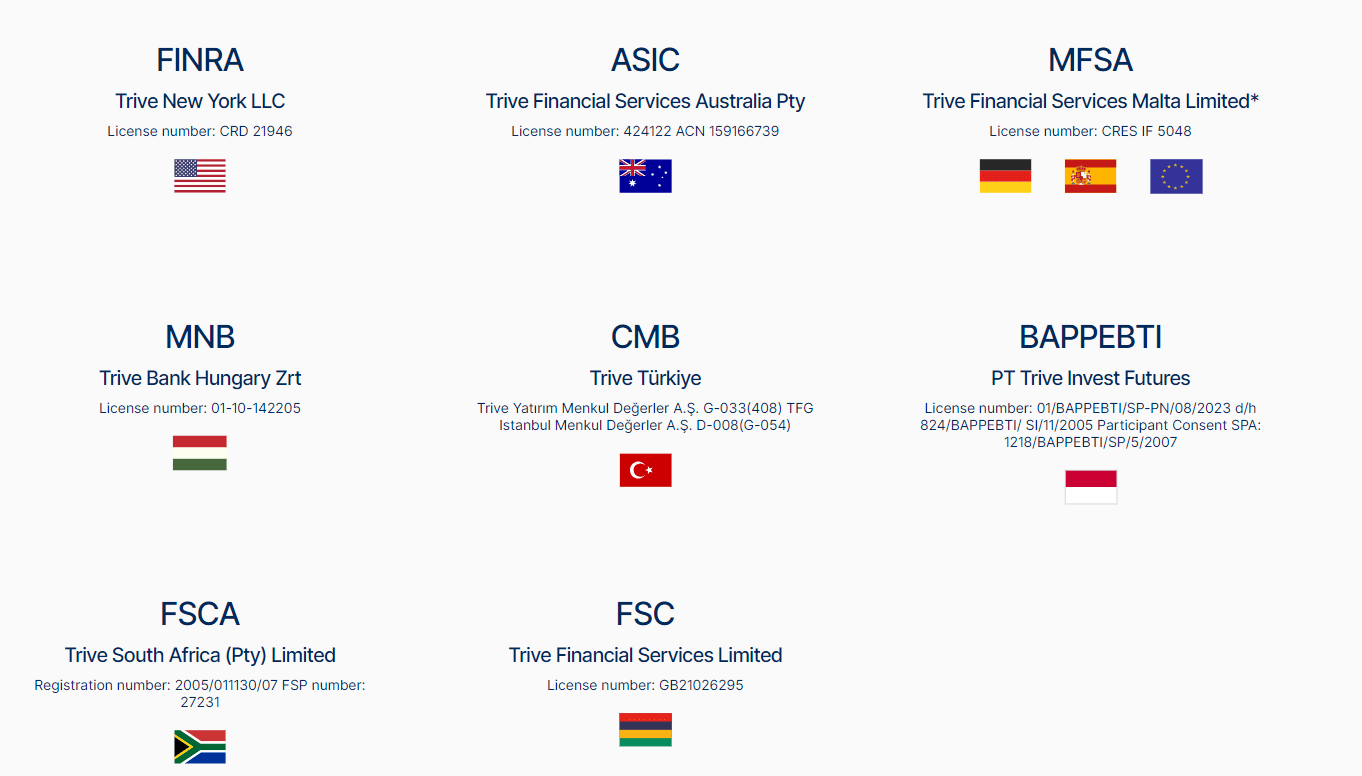

Trive Licenses and Regulatory

Trive operates under a robust regulatory framework, holding licenses from multiple respected financial authorities worldwide. This multi-jurisdictional approach to regulation demonstrates the broker's commitment to maintaining high standards of security, transparency, and ethical practices.

| Regulator | Entity | License/Registration No. | Regulatory Scope |

|---|---|---|---|

| Australian Securities and Investments Commission (ASIC) | Trive Financial Services Australia Pty Ltd | AFSL No. 424122 | Strict oversight and client protection measures |

| Malta Financial Services Authority (MFSA) | Trive Financial Services Malta Ltd | License No. IS/60473 | MiFID II compliance, EU financial standards |

| Financial Services Commission of the British Virgin Islands (BVI FSC) | Trive International Ltd. | License No. SIBA/L/14/1066 | Investment business authorization under BVI regulations |

| Financial Industry Regulatory Authority (FINRA) | Trive New York LLC | CRD No. 21946 | U.S. securities laws and FINRA rules compliance |

These licenses, along with others from the FSCA (South Africa), CMB (Turkey), and BAPPEBTI (Indonesia), ensure that Trive adheres to strict financial standards, client protection measures, and reporting requirements. Multi-jurisdictional regulation provides an added layer of security for clients' funds and enhances trust in the broker's operations.

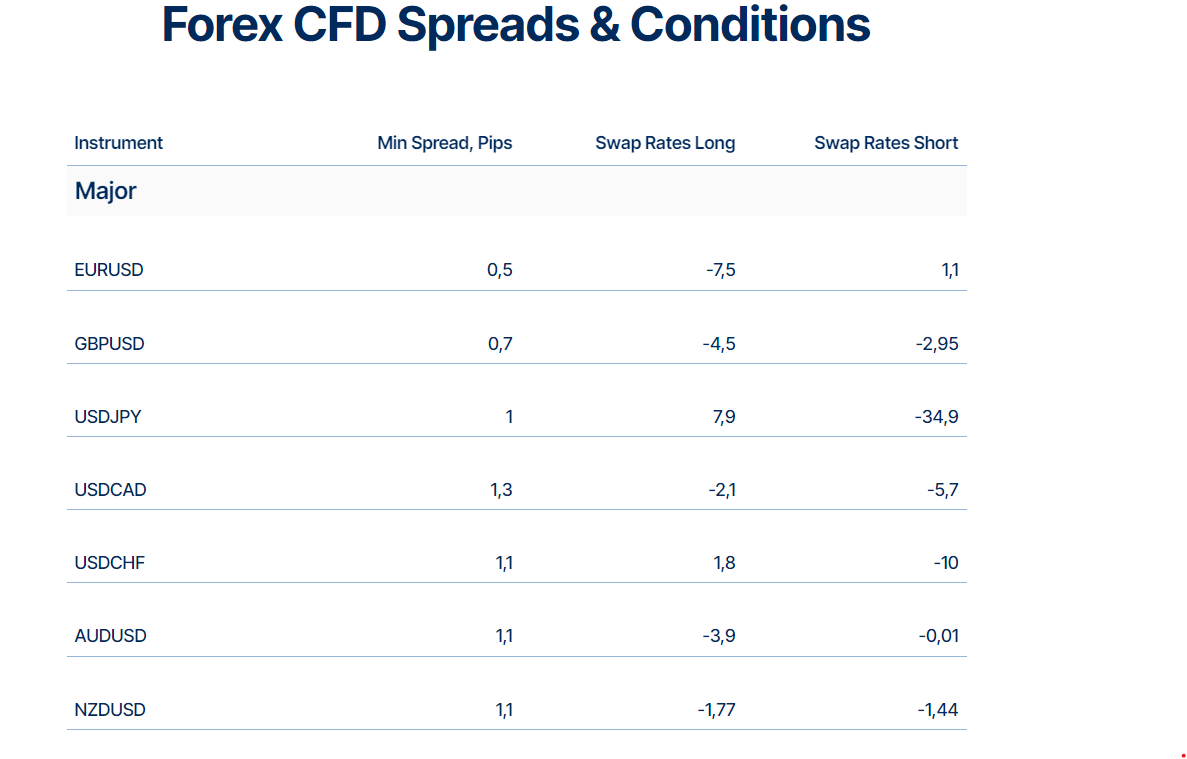

Trading Instruments

Trive offers a diverse range of tradable assets, catering to the needs and preferences of various types of traders. With over 170 instruments available, the broker provides access to multiple markets, allowing clients to build well-diversified trading portfolios.

| Category | Instruments Available |

|---|---|

| Forex | 40+ currency pairs |

| Stocks | 1000+ global shares |

| Indices | 12+ global indices |

| Commodities | Precious metals and energy |

| Cryptocurrencies | Bitcoin, Ethereum, Litecoin |

The availability of a diverse range of tradable assets is crucial for investors, as it allows them to spread risk across different markets and adapt their strategies to changing economic conditions. Trive's extensive offering demonstrates the broker's commitment to meeting the evolving needs of their clients and staying competitive in the industry.

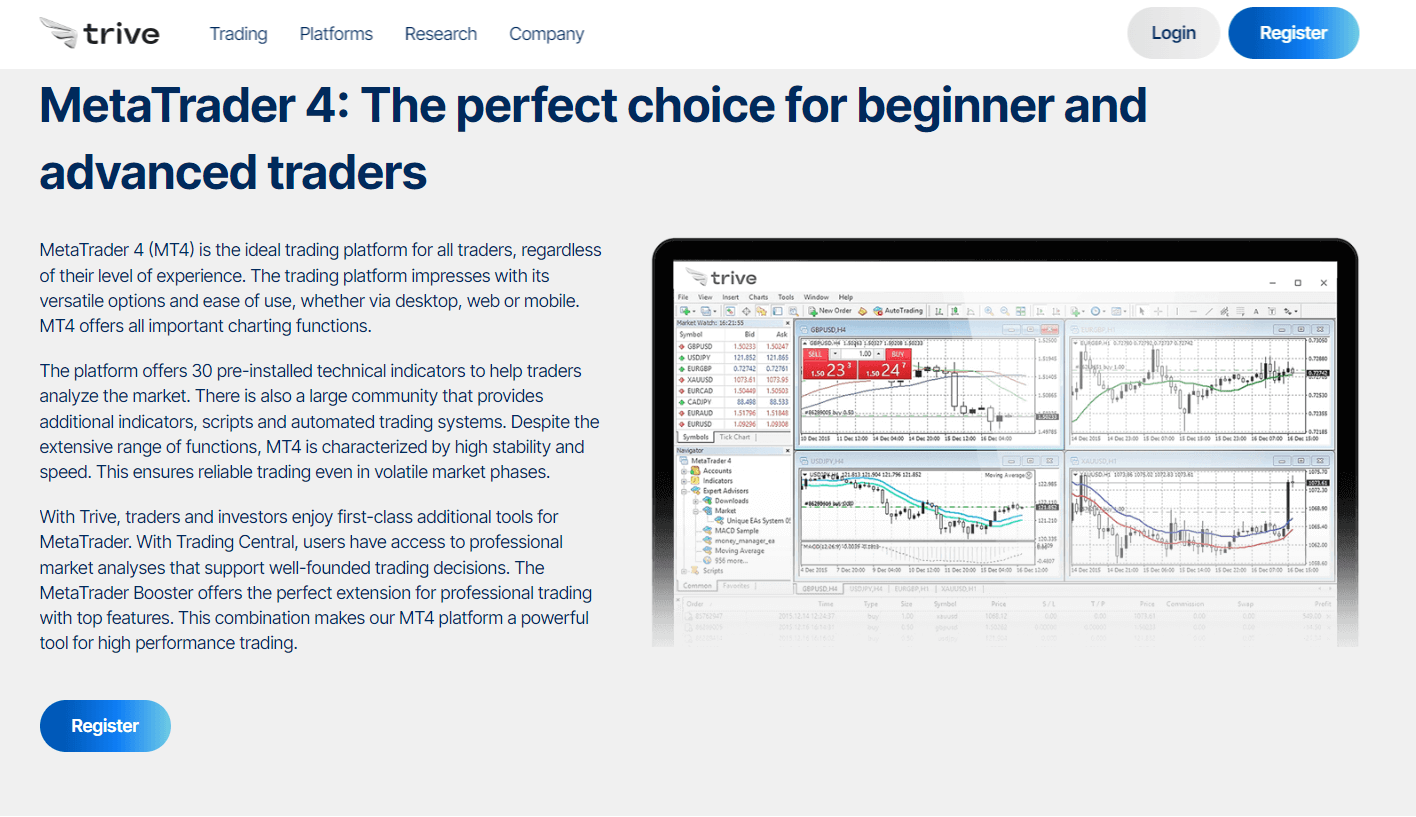

Trading Platforms

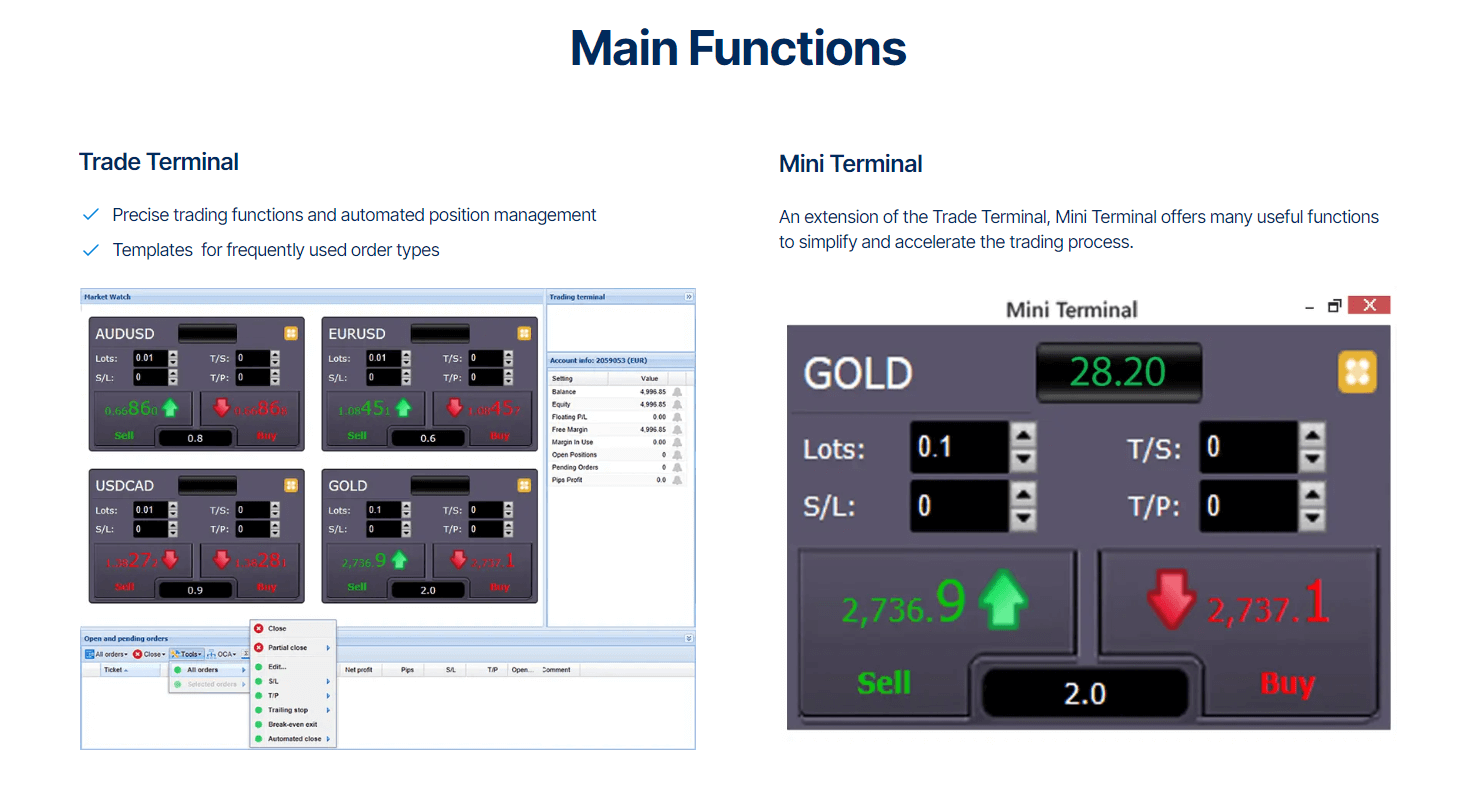

Trive offers a range of trading platforms to cater to the diverse needs and preferences of its clients. By providing access to industry-standard platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), as well as a proprietary mobile trading app, Trive ensures that traders can access the markets using tools they are comfortable with.

| Platform | Key Features | Availability |

|---|---|---|

| MetaTrader 4 (MT4) | - 30+ built-in indicators and tools - Customizable charts and templates - Expert Advisors (EAs) for algorithmic trading - One-click trading and trailing stop functionality | Desktop, Web, Mobile |

| MetaTrader 5 (MT5) | - 38+ indicators and 44 graphical objects - 21 timeframes - Depth of Market (DOM) - Improved EAs and backtesting | Desktop, Web, Mobile |

| Proprietary Mobile App | - Intuitive interface - Real-time quotes and charts - Secure login with 2FA - iOS and Android compatible | Mobile (iOS, Android) |

| Web Trading | - Real-time pricing and execution - Customizable layouts - Comprehensive charting tools - Secure browser access | Web Browser |

The availability of multiple trading platforms is crucial for brokers to meet the diverse needs of their clients. By offering stable, popular, and feature-rich platforms like MT4 and MT5, Trive ensures that traders can access the markets using tools that are reliable, efficient, and aligned with their trading strategies.

Trading Platforms Comparison Table

| Feature | MT4 | MT5 | Proprietary Mobile App | Web Trading |

|---|---|---|---|---|

| Technical Indicators | 30+ | 38+ | Basic | Comprehensive |

| Charting Timeframes | 9 | 21 | Limited | Multiple |

| EAs / Algorithmic Trading | Yes | Yes | No | No |

| One-Click Trading | Yes | Yes | Yes | Yes |

| Trailing Stops | Yes | Yes | Yes | Yes |

| Depth of Market | No | Yes | No | Yes |

| Customizable Interface | Yes | Yes | Limited | Yes |

| Mobile Availability | iOS, Android | iOS, Android | iOS, Android | Mobile browser |

Please note that the specific features and tools available on each platform may be subject to change and can vary depending on the client's account type and jurisdiction.

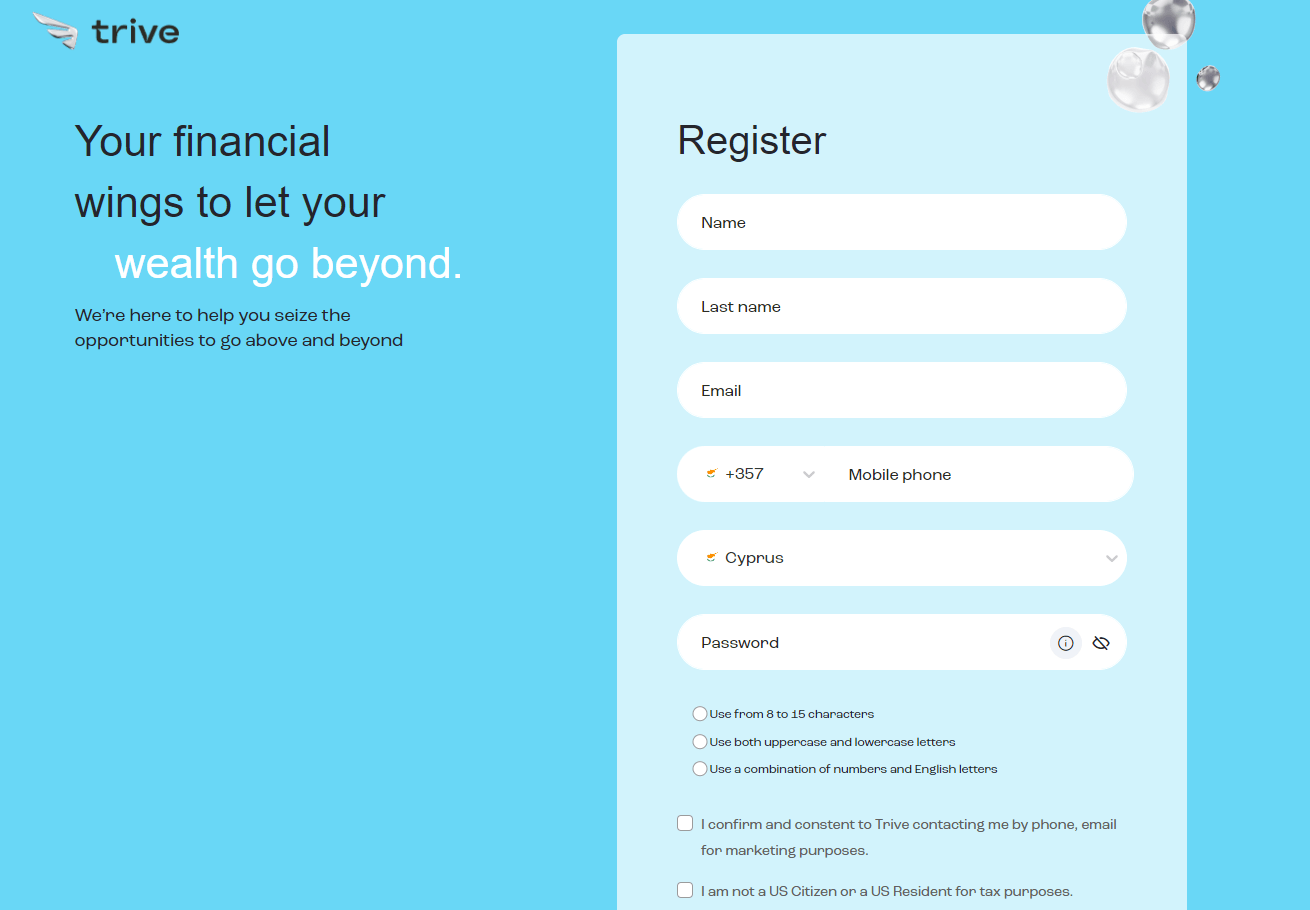

Trive How to Open an Account: A Step-by-Step Guide

Opening an account with Trive is a straightforward process that can be completed online in a few simple steps. Before getting started, it's essential to ensure that you meet the broker's requirements and have the necessary documentation ready.

Requirements for Opening an Account:

- Minimum age of 18 years old

- Valid government-issued identification document (e.g., passport, driver's license, or national ID card)

- Proof of residence (e.g., utility bill or bank statement)

- Minimum deposit amount (varies depending on account type)

Accepted Payment Methods:

Trive offers several convenient payment methods for funding your account, including:

- Bank wire transfer

- Credit/debit cards (Visa, Mastercard)

- E-wallets (Neteller, Skrill)

Processing times may vary depending on the chosen payment method, with e-wallets and credit/debit card deposits typically being the fastest (instant to 1 business day). Bank wire transfers may take 2-5 business days to process.

Account Registration Process

1. Visit Trive's official website and click on the "Open an Account" button.

2. Select your preferred account type and base currency (USD, EUR, GBP, or ZAR).

3. Fill in your personal information, including your full name, date of birth, country of residence, and contact details.

4. Provide your employment status and financial information, such as your estimated annual income and source of funds.

5. Choose your preferred trading platform (MT4, MT5, or proprietary mobile app) and leverage.

6. Upload the required identification documents and proof of residence.

7. Review and accept Trive's terms and conditions, risk disclosure statement, and privacy policy.

8. Submit your application and wait for Trive to review and approve your account (typically within 1-2 business days).

9. Once approved, fund your account using one of the available payment methods and start trading.

Charts and Analysis

Trive offers a comprehensive suite of educational resources and tools to support its clients' trading activities and enhance their market knowledge. These resources are designed to cater to traders of all experience levels, from beginners to seasoned professionals.

| Feature | Description |

|---|---|

| Market Analysis | TriveHUB provides in-depth market breakdowns for forex, stocks, indices, and commodities, covering both technical and fundamental analysis. |

| Trading Central Partnership | Trive collaborates with Trading Central to offer expert trading ideas, price forecasts, and detailed technical analysis. |

| Charting Tools | - 30+ built-in technical indicators - Customizable charting layouts - Multiple timeframes - Trend lines & Fibonacci tools - Real-time price data & backtesting |

| Economic Calendar | Covers key global economic events such as GDP releases, central bank meetings, and employment reports, with forecasts and past data. |

| Webinars & Educational Videos | Live and on-demand webinars covering trading strategies, platform tutorials, market analysis, and risk management. |

| Downloadable Guides & eBooks | Available through TriveHUB, covering technical analysis, fundamental analysis, trading psychology, and money management. |

| Market News & Sentiment | Real-time news and sentiment indicators integrated into trading platforms for informed decision-making. |

Compared to industry standards, Trive's educational offering is comprehensive and well-rounded, catering to a wide range of trading styles and experience levels. The combination of in-house and third-party content, along with the diverse formats (written analysis, webinars, videos, and downloadable guides), sets Trive apart from many competitors.

Trive Account Types

Trive offers four distinct account types, each designed to cater to the unique needs and preferences of different traders. Whether you're a novice or an experienced trader, Trive has an account type that suits your trading style and goals.

Account Types Comparison Table

| Feature | Standard | Pro Leverage | ECN Zero | VIP |

|---|---|---|---|---|

| Spreads from | 1.2 pips | 1.2 pips | 0.0 pips | 0.6 pips |

| Leverage up to | 1:500 | 1:2000 | 1:500 | 1:500 |

| Minimum Deposit | $0 | $0 | $0 | $2,000 |

| Commissions | No | No | $10/lot | No |

| Access to Assets | All | All | All | All |

| Trading Suitability | General trading strategies | High-risk, high-volume trading | Scalping & algorithmic trading | Premium trading conditions |

| Dedicated Account Manager | No | No | No | Yes |

| Priority Support | No | No | No | Yes |

| Exclusive Market Analysis | No | No | No | Yes |

Trive's range of account types demonstrates the broker's commitment to meeting the diverse needs of its clients. By offering accounts with varying spreads, leverage, and minimum deposit requirements, Trive ensures that traders can select an account that aligns with their risk tolerance, trading experience, and financial goals.

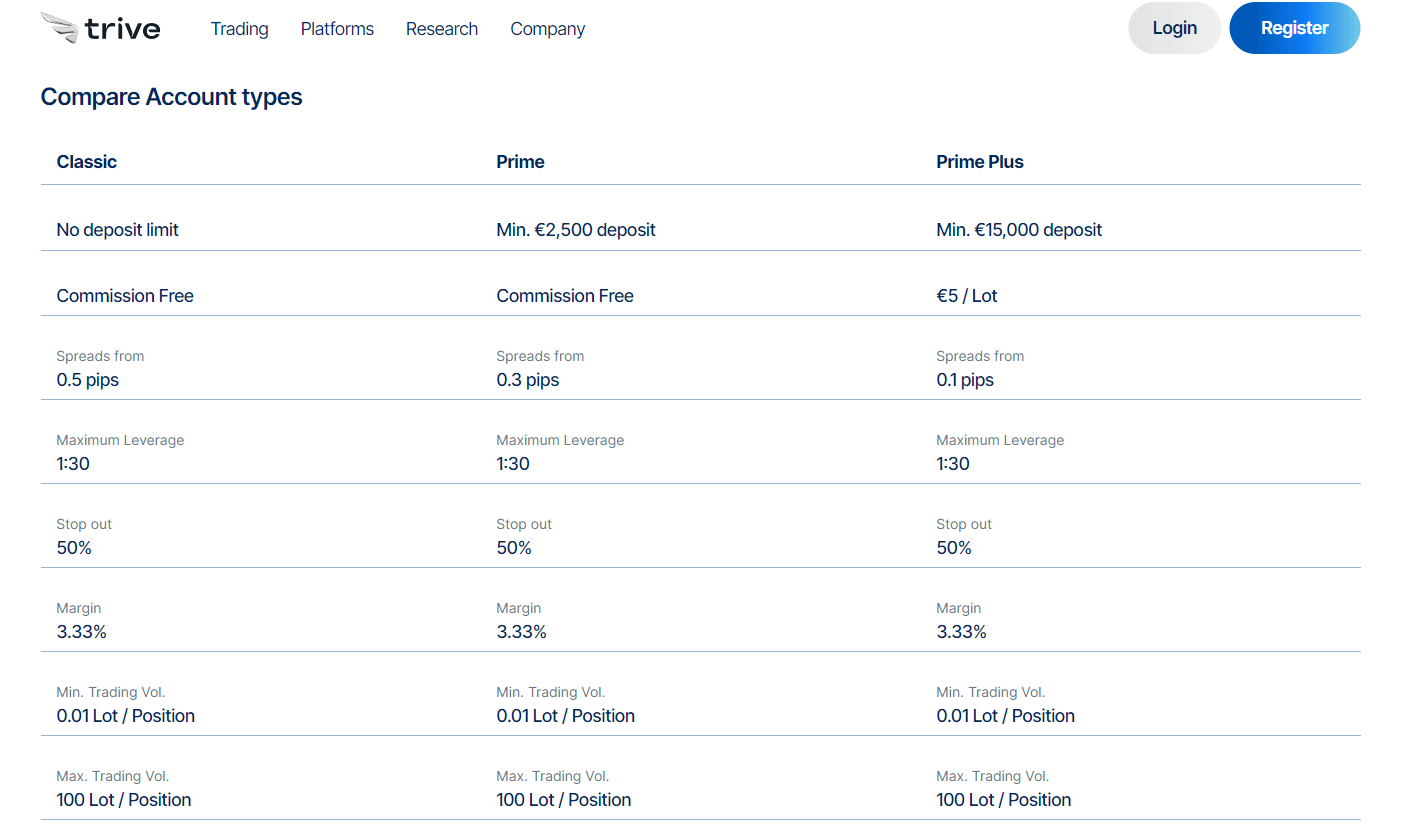

| Feature | Classic | Prime | Prime Plus |

|---|---|---|---|

| Minimum Deposit | None | €2,500 | €15,000 |

| Commission | No | No | €5 per lot |

| Spreads from | 0.5 pips | 0.3 pips | 0.1 pips |

| Maximum Leverage | 1:30 | 1:30 | 1:30 |

| Stop Out Level | 50% | 50% | 50% |

| Margin Requirement | 3.33% | 3.33% | 3.33% |

| Min. Trading Volume | 0.01 lot/position | 0.01 lot/position | 0.01 lot/position |

| Max. Trading Volume | — (not specified) | 100 lots per position | 100 lots per position |

Negative Balance Protection

Trive's Negative Balance Protection Policy: Trive offers negative balance protection to its clients, demonstrating its commitment to responsible trading and risk management. However, the availability and extent of this protection may vary depending on the regulatory jurisdiction of the Trive entity a client is registered with. For clients under the jurisdiction of Trive's European entities, such as Trive Financial Services Malta Ltd (regulated by the MFSA), negative balance protection is provided as a mandatory requirement in accordance with the European Securities and Markets Authority (ESMA) regulations. This means that European clients cannot lose more money than they have deposited in their trading account. However, for clients registered with Trive's non-European entities, such as Trive International Ltd (regulated by the BVI FSC) or Trive Financial Services Australia Pty Ltd (regulated by ASIC), the negative balance protection policy may differ. These entities may offer negative balance protection on a discretionary basis or with certain limitations. It is essential for traders to carefully review the specific terms and conditions of negative balance protection provided by the Trive entity they are registered with. This information can be found in the broker's legal documents, such as the Client Agreement and Risk Disclosure Statement, which are available on Trive's official website.

Trive Deposits and Withdrawals

Trive offers a range of convenient and secure deposit and withdrawal methods to cater to the diverse needs of its global client base. The broker understands the importance of efficient and reliable fund transfers, ensuring that traders can quickly fund their accounts and access their profits.

Deposit Methods

| Deposit Method | Processing Time | Details |

|---|---|---|

| Bank Wire Transfer | 1-5 business days | Suitable for larger deposits; direct bank-to-account transfer. |

| Credit/Debit Cards | Instant | Visa & Mastercard accepted; ideal for smaller deposits. |

| E-Wallets | Instant | Supports Neteller and Skrill for quick funding. |

| Cryptocurrencies | Fast (Varies by network) | Deposits in Bitcoin, Ethereum, and other major cryptocurrencies. |

Withdrawal Methods

Trive offers the same methods for withdrawals as it does for deposits, ensuring a seamless and consistent experience for traders. Withdrawal requests are processed within 1-3 business days, subject to the broker's verification and approval process. Fees and Limits: Trive does not charge any deposit fees for bank wire transfers, while credit/debit card and e-wallet deposits may incur a 1.5% fee. Cryptocurrency deposits are typically free of charge. Withdrawal Fees Table| Withdrawal Method | Fees | Additional Notes |

|---|---|---|

| Bank Wire Transfer | No fees (Trive) | Banks may charge their own fees. |

| Credit/Debit Cards | 1.5% | Applies to Visa & Mastercard withdrawals. |

| E-Wallets | 1.5% | Applies to Neteller and Skrill withdrawals. |

| Cryptocurrencies | No fees (Trive) | Network fees may apply based on blockchain congestion. |

Support Service for Customer

In the fast-paced world of online trading, reliable customer support is crucial for a positive trading experience. Traders need to know that they can quickly access help and guidance when needed, whether they have questions about account setup, platform features, or trading strategies. Trive understands the importance of providing excellent customer support and offers multiple channels for traders to reach out for assistance.

| Support Channel | Availability | Response Time | Additional Notes |

|---|---|---|---|

| Live Chat | 24/5 | Instant | Quickest way for simple queries. |

| 24/5 | Within 24 hours | Contact: support@trive.com | |

| Phone | 24/5 | < 5 minutes | Multilingual support with regional numbers: |

| International: +44 14 6094 4002 | |||

| China: +86 40 0842 7771 | |||

| India: +91 18 0027 04273 | |||

| South Korea: +82 70 4731 8492 | |||

| Social Media | Business hours | Varies | Available on Facebook, Twitter, and Instagram. |

Availability and Response Times

Trive's customer support team is available 24/5, from Monday to Friday. The live chat feature is the quickest way to get assistance, with an average response time of under 1 minute. Emails are typically responded to within 24 hours, while phone support aims to connect traders with a representative within 5 minutes. For VIP account holders, Trive offers dedicated account managers who provide personalized support and guidance. These account managers are available during extended hours and can be reached directly via phone or email. Trive's commitment to providing excellent customer support sets them apart from many competitors in the industry. The broker's multilingual support team, multiple communication channels, and 24/5 availability ensure that traders can access the help they need when they need it.Prohibited Countries

Trive, like many international forex and CFD brokers, is subject to various regulations and licensing requirements that restrict its operations in certain countries and regions. These restrictions are put in place to ensure compliance with local laws, protect consumers, and mitigate potential legal and financial risks.

Reasons for Restrictions:

The primary reasons behind Trive's country restrictions include:

1. Local Regulations: Some countries have strict regulations governing forex and CFD trading, requiring brokers to obtain specific licenses or meet certain criteria to operate legally. If Trive does not meet these requirements, it cannot offer its services in those countries.

2. Licensing Limitations: Trive's licenses from regulatory bodies such as ASIC, MFSA, and BVI FSC may have limitations on the countries where the broker can operate. For example, an ASIC license may not allow Trive to offer its services to residents of the United States.

3. Geopolitical Factors: Political instability, economic sanctions, or other geopolitical factors may make it difficult or impossible for Trive to operate in certain regions.

Prohibited Countries and Regions

Based on the information provided, Trive does not accept clients from the following countries and regions:

- Iran

- Myanmar

- North Korea

- United States

- United Kingdom

- Any other territory where such activity is prohibited by local authorities

Consequences of Trading from Prohibited Countries:

Attempting to trade with Trive from a prohibited country can result in several consequences, including:

1. Account Suspension or Termination: If Trive discovers that a client is trading from a prohibited country, the broker may suspend or terminate their account without prior notice.

2. Funds Forfeiture: In some cases, clients from prohibited countries may have their funds frozen or forfeited, as Trive cannot legally process transactions from these regions.

3. Legal Action: Depending on the severity of the violation and the local laws, clients trading from prohibited countries may face legal action or penalties.

It is crucial for traders to carefully review Trive's terms and conditions and ensure they are not residing in or trading from any of the prohibited countries before opening an account. If in doubt, traders should contact Trive's customer support for clarification and guidance.

Special Offers for Customers

Trive does not currently appear to have any specific promotions, bonuses, or special offers mentioned. The scraped content did not include details about sign-up incentives, loyalty programs, trading contests, or third-party partnerships that are actively being promoted.

Conclusion

Throughout this comprehensive review, I have thoroughly examined Trive's operations, regulatory compliance, trading offerings, and overall reputation. Drawing upon the insights gathered, I can confidently conclude that Trive is a trustworthy and reliable broker that prioritizes the safety and satisfaction of its clients.

One of the standout features of Trive is its strong regulatory framework. With licenses from respected authorities such as ASIC, MFSA, and BVI FSC, Trive demonstrates a commitment to operating transparently and adhering to strict financial standards. This multi-jurisdictional approach to regulation provides an added layer of protection for clients' funds and enhances trust in the broker's operations.

Trive's trading offerings are designed to cater to a wide range of traders, from beginners to experienced professionals. The broker provides access to an extensive selection of tradable assets, including forex, stocks, indices, commodities, and cryptocurrencies. With competitive spreads, flexible leverage options, and a choice of account types, Trive ensures that traders can tailor their experience to their specific needs and goals.

In terms of trading platforms, Trive excels by offering the industry-standard MetaTrader 4 and MetaTrader 5, along with a proprietary mobile trading app. These platforms are known for their reliability, advanced charting tools, and automated trading capabilities, providing traders with a seamless and efficient trading experience.

Trive's commitment to education and support is another area where they shine. The broker offers a comprehensive suite of educational resources, including webinars, tutorials, and market analysis, to help traders improve their skills and stay informed about market trends. The customer support team is available 24/5 through multiple channels, ensuring that clients can access assistance whenever they need it.

While Trive does not currently appear to have any active promotions or bonuses, this may be subject to change. Traders should always refer to the broker's official website for the most up-to-date information on any special offers.

It is important to note that Trive has some country restrictions, and traders should ensure they are not residing in or trading from any prohibited jurisdictions before opening an account.

In conclusion, Trive emerges as a reputable and trustworthy broker that combines strong regulation, diverse trading offerings, and a commitment to client education and support. With its user-friendly platforms, competitive trading conditions, and focus on transparency, Trive is well-suited for traders seeking a reliable partner in their trading journey.