ZFX Broker Review : Pros, Cons & Key Factors

ZFX

United Kingdom

United Kingdom

-

Minimum Deposit $50

-

Withdrawal Fee $varies

-

Leverage 1:2000

-

Spread From 0.2

-

Minimum Order 0.01

-

Forex Available

-

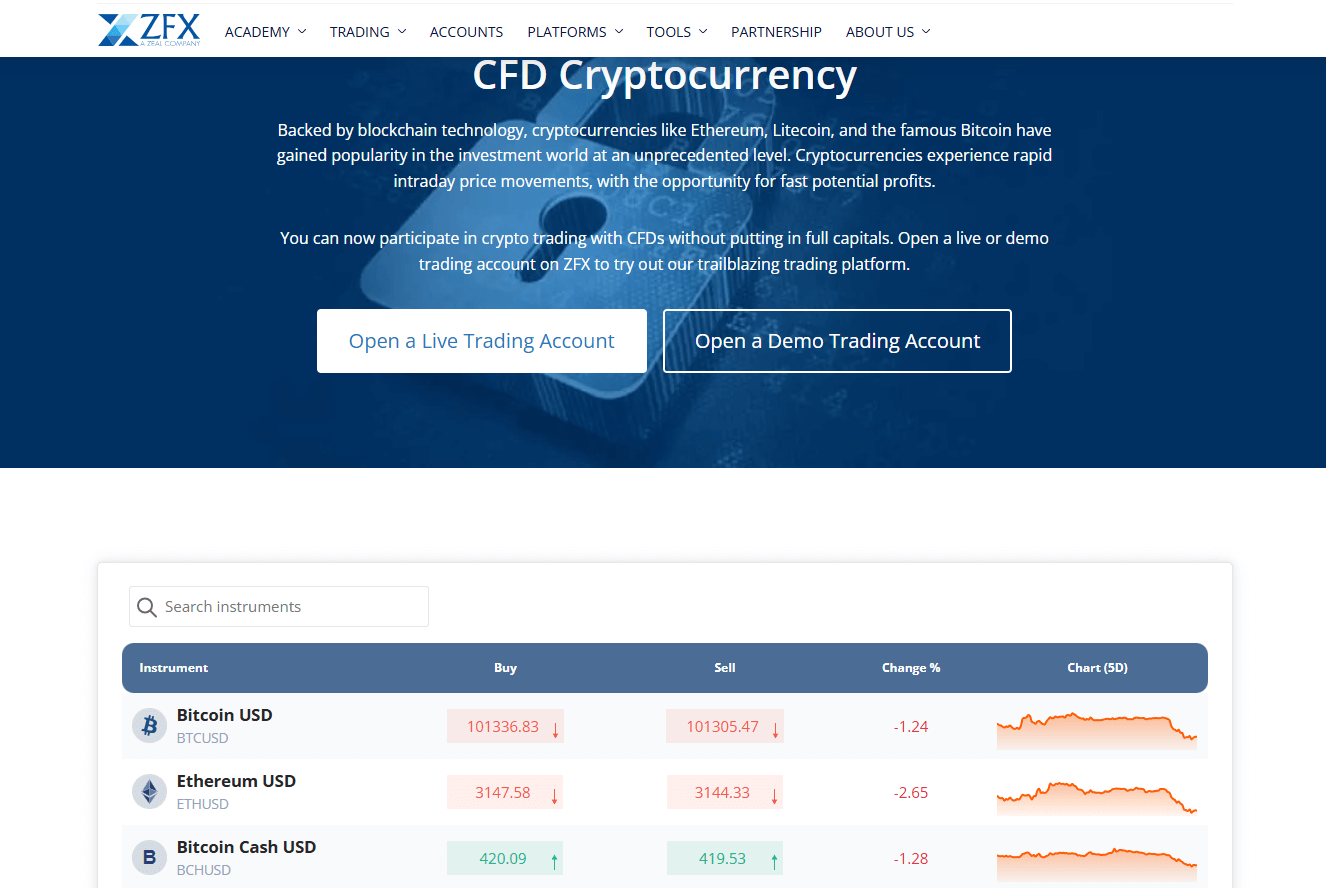

Crypto Available

-

Stock Available

-

Indices Available

Licenses

United Kingdom Market Making (MM)

United Kingdom Market Making (MM)

Cyprus Market Making (MM)

Cyprus Market Making (MM)

Softwares & Platforms

Customer Support

+444008424611

(English)

+444008424611

(English)

Supported language: Chinese (Simplified), English, Indonesian, Thai, Vietnamese

Social Media

Summary

ZFX (Zeal Forex) is a multi-asset brokerage offering forex and CFD trading with competitive spreads, flexible account types, and access to the MetaTrader 4 (MT4) platform. The broker provides high leverage of up to 1:2000, depending on the account balance, and supports multiple deposit and withdrawal methods with no transaction fees

- Regulated by FCA (UK) and FSA (Seychelles)

- MetaTrader 4 platform with advanced tools

- Competitive spreads from 0.2 pips

- Leverage up to 1:2000

- Low minimum deposit of $50 for Mini accounts

- Negative balance protection

- 100+ tradable instruments

- Responsive customer support

- MAM/PAMM accounts for money managers

- Partnership programs for IBs and affiliates

- Limited educational resources compared to some competitors

- No web-based trading platform

- Higher minimum deposit of $1,000 for ECN accounts

- No crypto trading

- Inactivity fees apply after 90 days

- Limited research and market analysis

- No US clients accepted

- Occasional bonuses and promotions

- No guaranteed stop loss

- Restrictions on scalping and hedging

Overview

ZFX, a prominent forex and CFD broker, was founded in 2016 as part of the Zeal Group. Headquartered in London, ZFX operates globally with offices in Asia, Europe, and the Middle East. Regulated by the FCA (UK) and FSA (Seychelles), ZFX prioritizes client security and offers competitive trading conditions on the MetaTrader 4 platform.

With a focus on providing access to a wide range of markets, including forex, indices, commodities, and stocks, ZFX caters to both novice and experienced traders. The broker's commitment to transparency and innovation has earned it recognition in the industry. Visit zfx.co.uk for more details on their services and offerings.

Overview Table

| Category | Details |

|---|---|

| Foundation Year | 2016 |

| Headquarters | London, United Kingdom |

| Regulation | FCA (UK), FSA (Seychelles) |

| Trading Platforms | MetaTrader 4 (Desktop, Mobile) |

| Account Types | Mini, Standard STP, ECN, Professional |

| Minimum Deposit | $50 (Mini), $200 (Standard STP), $1,000 (ECN), $10,000 (Professional) |

| Leverage | Up to 1:2000 (Retail), 1:100 (Professional) |

| Instruments | Forex, Indices, Commodities, Stocks |

| Execution Model | NDD (STP, ECN) |

| Client Fund Security | Segregated Accounts, Negative Balance Protection |

Fact List

- ZFX is part of the Zeal Group, a global conglomerate of fintech companies.

- The broker is regulated by the FCA (UK) and FSA (Seychelles), ensuring a secure trading environment.

- ZFX offers the MetaTrader 4 platform for desktop and mobile trading.

- Clients can choose from Mini, Standard STP, ECN, and Professional account types.

- Minimum deposits range from $50 to $10,000, depending on the account type.

- Leverage up to 1:2000 is available for retail clients and 1:100 for professionals.

- ZFX provides access to a diverse range of instruments, including forex, indices, commodities, and stocks.

- The broker employs an NDD execution model, offering STP and ECN accounts for transparent pricing.

- Client funds are held in segregated accounts, and negative balance protection is provided.

- ZFX's commitment to innovation and client satisfaction has earned it recognition in the industry.

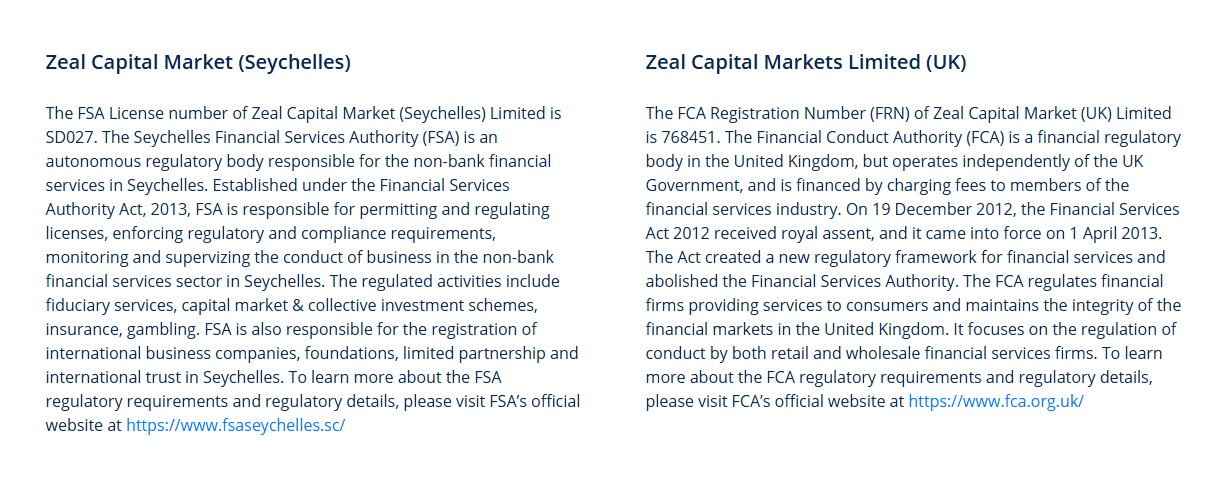

ZFX Licenses and Regulatory

ZFX operates under the regulatory oversight of two primary authorities: the Financial Conduct Authority (FCA) in the UK and the Financial Services Authority (FSA) in Seychelles. The FCA is known for its stringent standards, ensuring transparency and fairness, while the FSA provides oversight for brokers in its jurisdiction.

Dual regulation enhances client security and trust, as the broker must adhere to the guidelines set by both authorities. ZFX segregates client funds and offers negative balance protection, further safeguarding investors' assets. Compared to the industry, ZFX's regulatory framework is robust, instilling confidence in its operations.

| Regulatory Authority | Entity Name | Registration/License Number |

|---|---|---|

| FCA (UK) | Zeal Capital Market (UK) Limited | 768451 |

| FSA (Seychelles) | Zeal Capital Market (Seychelles) Limited | SD027 |

Trading Instruments

ZFX offers a wide range of tradable instruments, providing opportunities for portfolio diversification:

| Asset Class | Description |

|---|---|

| Forex | Over 60 currency pairs, including major, minor, and exotic pairs. Competitive spreads from 0.2 pips on ECN accounts. |

| Commodities | Precious metals (gold, silver) and energy commodities (crude oil, natural gas). Allows hedging against market volatility. |

| Indices | CFDs on major global indices like NASDAQ 100 and S&P 500. Exposure to broader market movements. |

| Stocks | CFDs on shares of leading companies. Capitalize on individual stock performance without ownership. |

While comprehensive, ZFX's asset selection is slightly narrower than some competitors. However, it caters well to the needs of most traders.

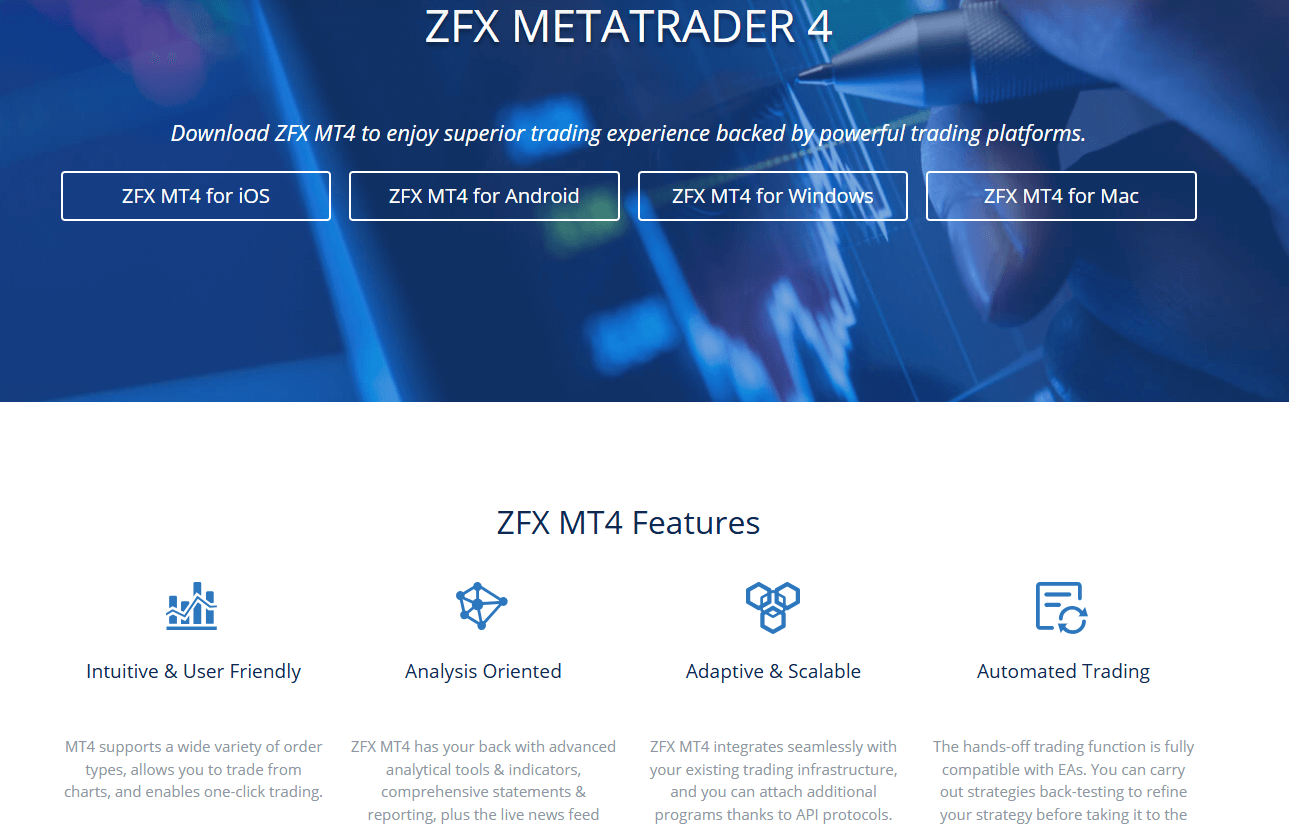

Trading Platforms

ZFX offers the MetaTrader 4 (MT4) platform for trading:

MetaTrader 4

- Available for desktop (Windows, Mac) and mobile (iOS, Android)

- User-friendly interface with advanced charting and analysis tools

- Supports automated trading via Expert Advisors (EAs)

- One-click trading functionality

ZFX's MT4 integration provides a stable, feature-rich environment for traders of all levels. The platform aligns well with industry standards and client expectations.

Trading Platforms Comparison Table

| Platform Feature | MT4 (Desktop) | MT4 (Mobile) | ZFX Mobile App |

|---|---|---|---|

| One-Click Trading | ✓ | ✓ | ✓ |

| Charting Package | ✓ | Limited | ✗ |

| Technical Indicators | 50+ | 30+ | ✗ |

| Automated Trading (EAs) | ✓ | ✗ | ✗ |

| Alerts & Notifications | ✓ | ✓ | ✓ |

Trading Methods List:

- MetaTrader 4 (MT4) for desktop

- MetaTrader 4 (MT4) for mobile

- ZFX proprietary mobile app

ZFX How to Open an Account: A Step-by-Step Guide

Opening an account with ZFX is quite simple and straightforward.

- Visit the official ZFX website zfx.co.uk and click "Open an Account."

- Fill out the registration form with your personal details

- Choose your account type (Mini, Standard STP, ECN)

- Verify your identity by uploading required documents

- Fund your account using an accepted payment method

- Start trading on the ZFX MT4 platform

Charts and Analysis

ZFX ensures providing a range of tools and resources to help clients enhance their trading knowledge and skills:

- MetaTrader 4 (MT4) platform: 50+ built-in technical indicators and drawing tools for in-depth market analysis

- Economic Calendar: Stay informed about upcoming market events and data releases

- Market News and Analysis: Daily market updates, technical and fundamental analysis articles

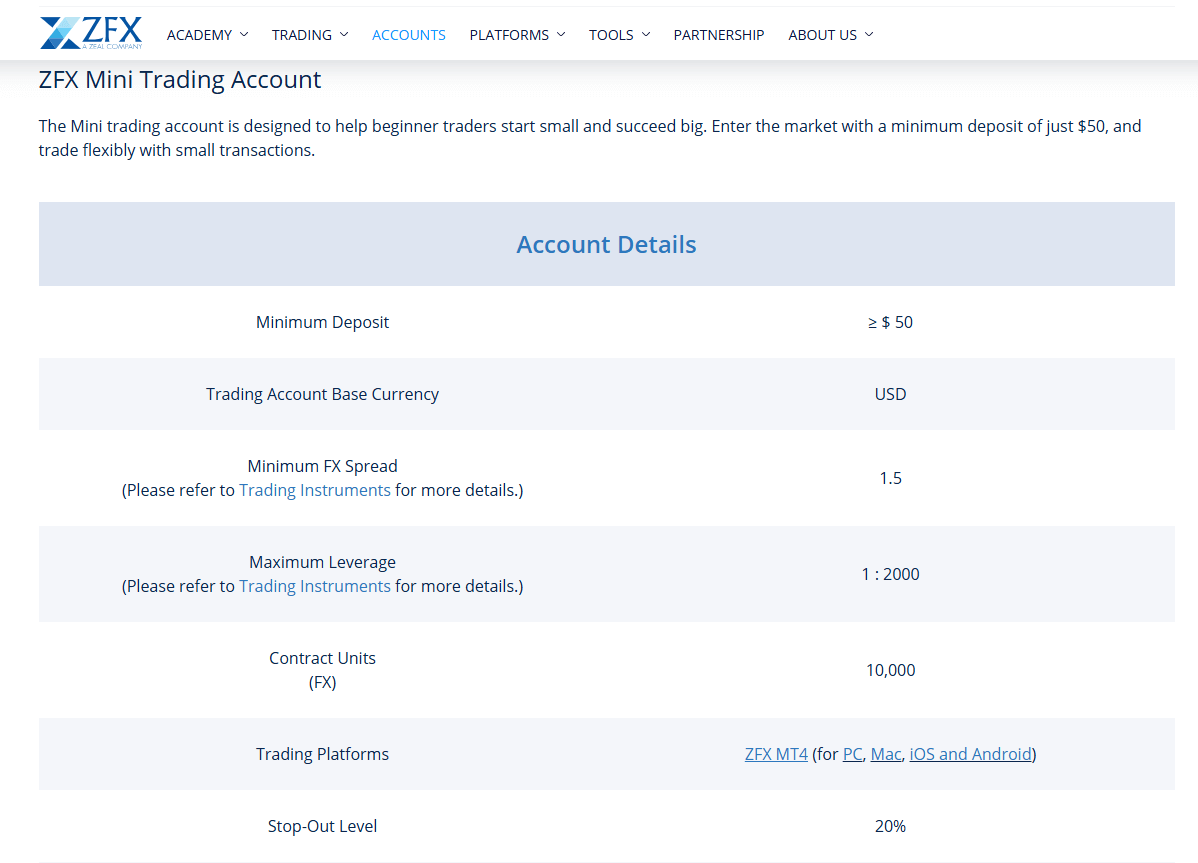

ZFX Account Types

ZFX offers 3 account types:

Mini Account

- Min deposit: $50

- Leverage: Up to 1:2000

- Spreads from 1.5 pips

- Micro lots (0.01)

Standard STP Account

- Min deposit: $200

- Leverage: Up to 1:500

- Spreads from 1.3 pips

- Standard lots (0.1)

ECN Account

- Min deposit: $1000

- Leverage: Up to 1:500

- Spreads from 0.2 pips + commission

- Standard lots (0.1)

Account Types Comparison Table

| Account Type | Minimum Deposit | Leverage | Spreads | Lot Size |

|---|---|---|---|---|

| Mini | $50 | 1:2000 | 1.5 pips | 0.01 |

| Standard STP | $200 | 1:500 | 1.3 pips | 0.1 |

| ECN | $1,000 | 1:500 | 0.2 pips + commission | 0.1 |

Negative Balance Protection

Negative balance protection ensures traders cannot lose more than their account balance, even in volatile markets. It prevents accounts from going into a negative balance due to trading losses. ZFX offers negative balance protection to all clients. If an account goes into negative equity, ZFX will zero out the balance so the trader does not owe money. This provides peace of mind and manages risk. Key points:

- Protects against losses exceeding account balance

- ZFX zeroes out negative balances

- Manages risk in volatile markets

- Applies to all ZFX clients

ZFX Deposits and Withdrawals

Deposit Methods

ZFX accepts the following deposit methods:| Category | Details |

|---|---|

| Deposit Methods | - Bank Transfer- Credit/Debit Card (Visa, Mastercard)- E-wallets (Skrill, Neteller, Perfect Money) |

| Minimum Deposit | - $50 (Mini Account)- $200 (Standard STP)- $1000 (ECN) |

| Deposit Fees | No deposit fees |

Whithdrawal Methods

ZFX accepts the following withdrawal methods:| Category | Details |

|---|---|

| Withdrawal Methods | - Bank Transfer- Credit/Debit Card- E-wallets (Skrill, Neteller, Perfect Money) |

| Minimum Withdrawal | $15 |

| Withdrawal Fees | No withdrawal fees |

| Processing Time | Processed within 24 hours |

Key points

- Multiple payment options

- broker does not charge for deposit or withdrawal

- Low minimum withdrawal of $15

- Fast withdrawal processing (24 hours)

Support Service for Customer

Reliable customer support is essential for a positive trading experience. ZFX offers several support channels:

- Live chat on website

- Email: support@zfx.co.uk

- Phone: +44 400-8424-611

- Social media (Facebook, Instagram, Twitter, LinkedIn)

Support is available 24/5

- Mon-Fri: 24 hours

- Weekends: 7:30am - 2:00am (next day)

Customer Support Comparison Table:

| ZFX Customer Support | Details |

|---|---|

| Support Languages | English, Chinese, Thai, Vietnamese, Indonesian |

| Support Provided By | In-house team |

| Support Hours | 24/5 |

| Email Response Time | Within 24 hours |

| Phone Support | Yes (+44 400-8424-611) |

| Live Chat | Yes |

| Social Media Support | Yes |

Key points:

- Multiple support channels

- 24/5 availability

- Multilingual support

- In-house support team

- Fast email response within 24 hours

ZFX prioritizes client support with an accessible, responsive in-house team. The variety of contact methods and extended availability cater well to global clients.

Prohibited Countries

ZFX is unable to provide services to residents of certain countries due to regulatory restrictions, licensing limitations, and other factors. It's crucial for traders to ensure they are eligible to open an account based on their country of residence.

ZFX does not accept clients from:

- United States

- Canada

- European Union (EU) countries

- Brazil

- Egypt

- Iran

- North Korea

Attempting to trade from a prohibited jurisdiction may result in account closure and funds being returned.

Special Offers for Customers

While ZFX does not currently have any active promotions, they occasionally run competitions and offer prizes for traders:

| Category | Details |

|---|---|

| Trading Competitions | - ZFX periodically hosts trading competitions.- Participants can win cash prizes, gift items, or trading bonuses.- Specific registration and trading period requirements apply. |

| Refer-a-Friend Program | - ZFX has offered a referral program in the past.- Existing clients could earn rewards for introducing new traders to the platform. |

ZFX also has several partnership programs:

- Introducing Brokers (IB): Earn commissions for referring clients to ZFX. Flexible rebate options and reporting tools.

- Marketing Affiliates: Promote ZFX and earn commissions on referred trading volume. Access to marketing materials and tracking.

- MAM/PAMM Accounts: For money managers looking to trade on behalf of multiple client accounts. Integrated with MT4.

While not as extensive as some competitors, ZFX's occasional promotions and partnership offerings can provide added value for active traders and introducing brokers.

Conclusion

Throughout this comprehensive ZFX review, I've carefully analyzed various aspects of ZFX's operations, from their regulatory compliance and geographical reach to their trading platforms, trading instruments, account types, and customer support. By consolidating these findings, I aim to provide a cohesive assessment of ZFX's safety, reliability, and overall reputation as a broker.

One of the standout features of ZFX is their commitment to regulatory compliance, being authorized and regulated by both the FCA in the UK and the FSA in Seychelles. This dual oversight provides a robust framework for ensuring the protection of clients' funds and maintaining high standards of transparency and fairness.

ZFX's trading environment is characterized by a user-friendly interface, advanced tools, and a diverse range of tradable instruments. The MetaTrader 4 platform, available for desktop and mobile devices, offers a seamless trading experience with features like one-click trading, automated strategies, and comprehensive charting capabilities.

The broker's account types cater to traders of varying experience levels and investment sizes, with options like the Mini, Standard STP, and ECN accounts. These accounts offer competitive spreads, high leverage, and low minimum deposits, making ZFX accessible to a wide range of traders.

While ZFX's educational resources may not be as extensive as some competitors, they still provide essential tools and insights, such as an economic calendar, market analysis, and platform guides. The broker's customer support is responsive and available through multiple channels, ensuring that clients can access assistance when needed.

Although ZFX may not have the most extensive suite of promotional offers, they do provide occasional trading competitions and loyalty programs that can add value for active traders. The broker's partnership programs, including introducing broker and affiliate options, present attractive opportunities for those looking to collaborate with ZFX.

In conclusion, ZFX emerges as a reliable and reputable broker, offering a secure trading environment backed by strong regulation, advanced tools, and competitive account offerings. While there may be areas where ZFX can expand their services, such as educational content and bonus promotions, the broker's core strengths make them a solid choice for traders seeking a trustworthy and efficient platform.